Sukuk structures

The market for Sukuk is now maturing and different Sukuk structures have been emerging over the years; they can be of many types depending upon the type of Islamic modes of financing and trades used in its structuring. The AAOIFI issued standard for different types of Sukuk, classifying some of these Sukuk as tradable and others as non-tradable based on the type and characteristics of the issued Sukuk. There are also other diversified and mixed asset Sukuk that emerged in the market such as hybrid Sukuk, where the underlying pool of assets can comprise of Murabahah, Ijarah as well as Istisna’a. In any sukuk transaction, the issuance of sukuk certificates will simply raise a cash amount required by an originator. The issuance itself will not entitle the investors to a return on their investment and, therefore, must be supplemented with another Islamic financing structure.

Although it is possible to interpose a sukuk issuance onto any Islamic financing structure, historically, the most prevalent structures used in the sukuk space were Mudarabah, Musharakah, Murabahah and Ijarah, structures.

Mudarabah Sukuk are investment Sukuk that represent common ownership of units of equal value in the Mudarabah equity; the holders of Mudarabah Sukuk are the suppliers of capital (Rabb al-mal) and own shares in the Mudarabah equity and its returns according to the percentage of ownership share. Mudarabah Sukuk holders have the right to transfer the ownership by selling the deeds in the securities market. Mudarabah Sukuk should not contain a guarantee from the issuer or the manager for the fund, for the capital or a fixed profit, or a profit based on any percentage of the capital.

Musharakah Sukuk are investment Sukuk that represent ownership of Musharakah equity. It does not differ from the Mudarabah Sukuk except in the organization of the relationship between the party issuing such Sukuk and holders of these Sukuk, whereby the party issuing Sukuk forms a committee from the holders of the Sukuk who can be referred to for investment decisions. Musharakah Sukuk are ideal for borrowing to finance large commercial ventures, such as a factory expansion or construction projects. A special purpose vehicle company (SPV) can purchase, commission or construct Musharakah assets owned, or to be bought or constructed by the issuing entity. The SPV pays cash towards the capital of the Musharakah and then leases the underlying Musharakah assets to the issuing entity, for a period equal to the maturity of the Sukuk, at agreed regular fixed or floating rentals. Upon default or maturity, the issuing entity issues a promise to Musharakah units from the SPV at an agreed price. Musharakah Sukuk can be treated as negotiable instruments and can be bought and sold in the secondary market.

In the case of Murabahah Sukuk, the issuer of the certificate is the seller of the Murabahah commodity, the subscribers are the buyers of that commodity, and they are entitled to its final sale price upon the re-sale of the commodity. Murabahah Sukuk cannot be legally traded at the secondary market, as the certificates represent a debt owing from the subsequent buyer of the commodity to the Sukuk holders and such trading in debt on a deferred basis is not permitted by Shari’ah.

However, in 2008, AAOIFI issued a statement criticising the use of fixed price purchase undertakings to guarantee returns in Mudarabah and Musharakah structures. AAOIFI stated that these structures are intended to be similar to equity-based instruments and therefore any returns to the investors cannot be fixed at the outset – the investors must share any losses arising out of the sukuk assets. Subsequently, this led to a significant decline in musharaka and mudaraba based sukuk issuances as investors in the market were not prepared to invest in instruments that exposed them to risks that are not normally associated with debt-based instruments. As a consequence, since 2008, the Ijarah Sukuk structure has become the predominant structure with other structures, such as Wakalah Sukuk, also being increasingly utilised.

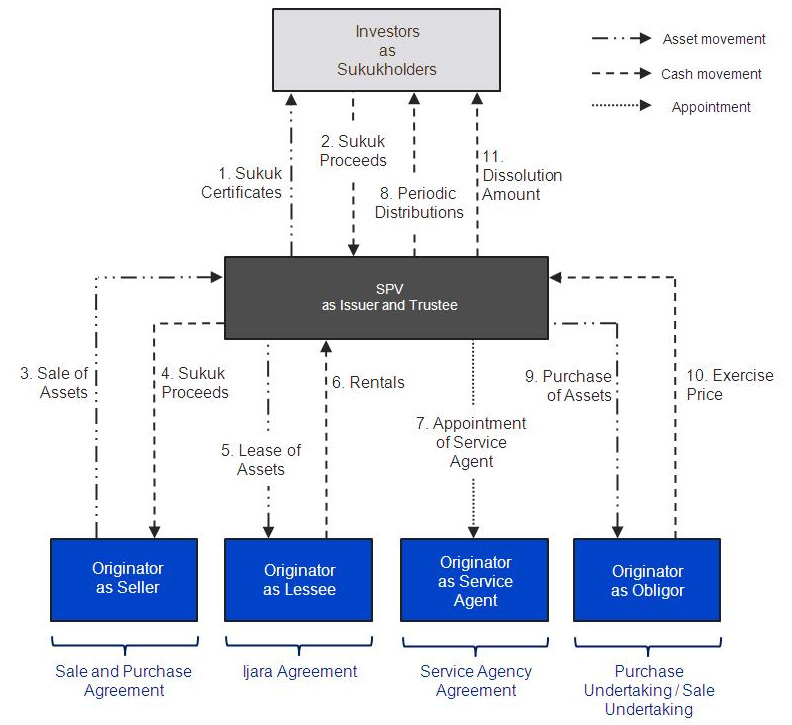

Ijarah Sukuk is a hybrid between an operational lease and a finance/capital lease with certain 'ownership' risks, such as the obligation to undertake capital maintenance of the leased asset and the obligation to insure the asset, remaining with the lessor. The lessor may appoint an agent, usually the lessee itself, to carry out these duties on its behalf under a servicing agency agreement. In a simple Ijarah Sukuk the originator, or a third party connected to the originator, will sell certain physical assets to a special purpose vehicle (SPV). The SPV will finance this acquisition by cash raised by the issue of sukuk certificates. The SPV will then lease the same physical asset to a third party, often the originator itself. The lease rental payments will 'mirror' the coupon payments due under the sukuk certificates and the cash flow from the lease rentals will be used to service those coupon payments.

represent ownership of equal shares in a rented real estate or the usufruct of the real estate. Holders of Ijarah Sukuk have the right to own the real estate, receive the rent and trade their Sukuk in the secondary markets; in exchange they bear all cost of maintenance of and damage to the real estate. The rental rates of return on those Sukuk can be fixed or floating depending on the agreement; it does not need to be linked to the period of taking usufruct by the lessee. The issuance of Ijarah Sukuk necessitates the creation of an SPV to purchase the assets, issue Sukuk to the investor, and make payment for purchasing the asset. Upon default or maturity, the issuing entity issues a promise to purchase the assets from the SPV at an agreed price.

Although it is possible to interpose a sukuk issuance onto any Islamic financing structure, historically, the most prevalent structures used in the sukuk space were Mudarabah, Musharakah, Murabahah and Ijarah, structures.

Mudarabah Sukuk are investment Sukuk that represent common ownership of units of equal value in the Mudarabah equity; the holders of Mudarabah Sukuk are the suppliers of capital (Rabb al-mal) and own shares in the Mudarabah equity and its returns according to the percentage of ownership share. Mudarabah Sukuk holders have the right to transfer the ownership by selling the deeds in the securities market. Mudarabah Sukuk should not contain a guarantee from the issuer or the manager for the fund, for the capital or a fixed profit, or a profit based on any percentage of the capital.

Musharakah Sukuk are investment Sukuk that represent ownership of Musharakah equity. It does not differ from the Mudarabah Sukuk except in the organization of the relationship between the party issuing such Sukuk and holders of these Sukuk, whereby the party issuing Sukuk forms a committee from the holders of the Sukuk who can be referred to for investment decisions. Musharakah Sukuk are ideal for borrowing to finance large commercial ventures, such as a factory expansion or construction projects. A special purpose vehicle company (SPV) can purchase, commission or construct Musharakah assets owned, or to be bought or constructed by the issuing entity. The SPV pays cash towards the capital of the Musharakah and then leases the underlying Musharakah assets to the issuing entity, for a period equal to the maturity of the Sukuk, at agreed regular fixed or floating rentals. Upon default or maturity, the issuing entity issues a promise to Musharakah units from the SPV at an agreed price. Musharakah Sukuk can be treated as negotiable instruments and can be bought and sold in the secondary market.

In the case of Murabahah Sukuk, the issuer of the certificate is the seller of the Murabahah commodity, the subscribers are the buyers of that commodity, and they are entitled to its final sale price upon the re-sale of the commodity. Murabahah Sukuk cannot be legally traded at the secondary market, as the certificates represent a debt owing from the subsequent buyer of the commodity to the Sukuk holders and such trading in debt on a deferred basis is not permitted by Shari’ah.

However, in 2008, AAOIFI issued a statement criticising the use of fixed price purchase undertakings to guarantee returns in Mudarabah and Musharakah structures. AAOIFI stated that these structures are intended to be similar to equity-based instruments and therefore any returns to the investors cannot be fixed at the outset – the investors must share any losses arising out of the sukuk assets. Subsequently, this led to a significant decline in musharaka and mudaraba based sukuk issuances as investors in the market were not prepared to invest in instruments that exposed them to risks that are not normally associated with debt-based instruments. As a consequence, since 2008, the Ijarah Sukuk structure has become the predominant structure with other structures, such as Wakalah Sukuk, also being increasingly utilised.

Ijarah Sukuk is a hybrid between an operational lease and a finance/capital lease with certain 'ownership' risks, such as the obligation to undertake capital maintenance of the leased asset and the obligation to insure the asset, remaining with the lessor. The lessor may appoint an agent, usually the lessee itself, to carry out these duties on its behalf under a servicing agency agreement. In a simple Ijarah Sukuk the originator, or a third party connected to the originator, will sell certain physical assets to a special purpose vehicle (SPV). The SPV will finance this acquisition by cash raised by the issue of sukuk certificates. The SPV will then lease the same physical asset to a third party, often the originator itself. The lease rental payments will 'mirror' the coupon payments due under the sukuk certificates and the cash flow from the lease rentals will be used to service those coupon payments.

represent ownership of equal shares in a rented real estate or the usufruct of the real estate. Holders of Ijarah Sukuk have the right to own the real estate, receive the rent and trade their Sukuk in the secondary markets; in exchange they bear all cost of maintenance of and damage to the real estate. The rental rates of return on those Sukuk can be fixed or floating depending on the agreement; it does not need to be linked to the period of taking usufruct by the lessee. The issuance of Ijarah Sukuk necessitates the creation of an SPV to purchase the assets, issue Sukuk to the investor, and make payment for purchasing the asset. Upon default or maturity, the issuing entity issues a promise to purchase the assets from the SPV at an agreed price.

Example of Ijaraha sukuk structure

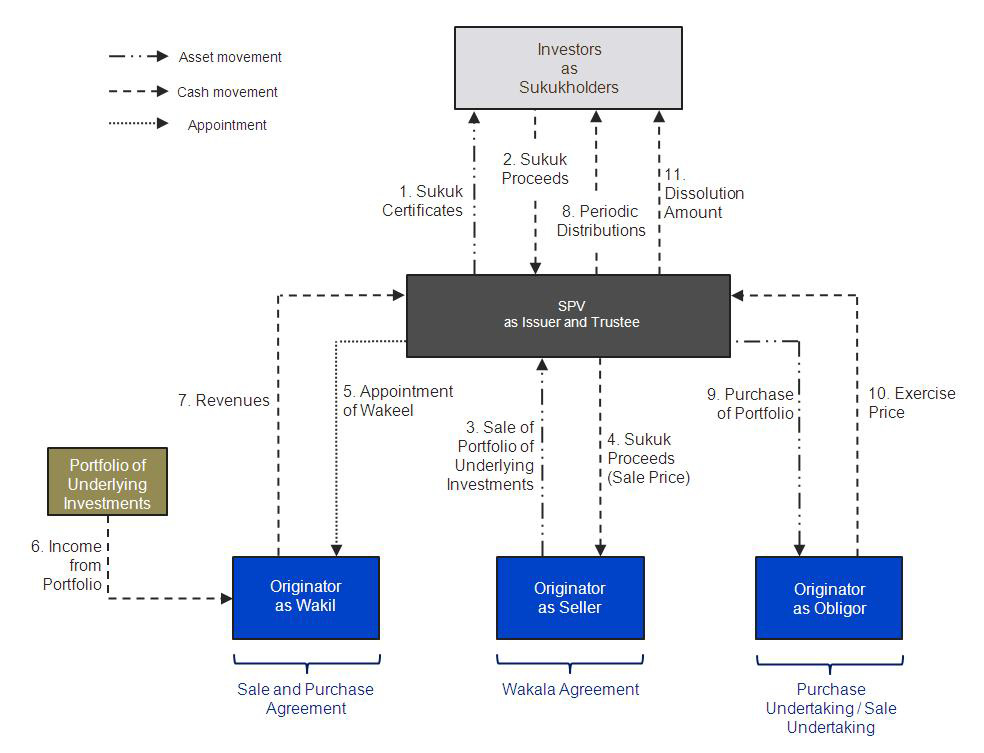

In a Wakalah Sukuk, an Islamic financial institution can package, its Ijarah contracts, murabahah receivables and any shares or Sukuk certificates held by it into a portfolio which is then sold to the investors. The income derived from the portfolio is used to service the coupon payments due under the sukuk certificates. The trustee will typically appoint the originator as its agent (wakil) to manage the portfolio. Unlike a musharaka or a mudaraba where the managing partner or the mudarib has some investment discretion, the wakil's role in a Wakalah Sukuk is generally limited to collecting income generated by the portfolio, maintaining the underlying assets comprised in the portfolio and acting on the instructions of the Trustee to replenish the portfolio with additional underlying assets from time to time. Given the limited nature of the wakil's role, the wakil is not held to be a partner or a mudarib in the arrangement for Shari'a purposes and therefore does not need to share the risk of loss in the arrangement. As a consequence of this, the originator in its corporate capacity is permitted, under Shari'a, to grant a fixed-price purchase undertaking to purchase the portfolio on redemption of the sukuk certificates.

Example of Ijaraha sukuk structure

Salam Sukuk are certificates of equal value issued for the purpose of mobilizing Salam capital. The issuer of the certificates is a seller of the goods of Salam; the holders are the buyers of the goods; they are entitled to the sale price of the certificates or the sale price of the Salam goods sold through a parallel Salam, if any. Investors pay in an advance funds to the SPV in return for a promise to deliver a commodity at a future date. SPV can appoint an agent to market the promised quantity at the time of delivery at a possible higher price. The profit of the holders of the Sukuk is the difference between the purchase price and the sale price.

Istisna’a Sukuk are certificates that carry equal value and are issued to mobilize funds required for production of goods products that will be owned by the certificate holders. The issuer of these certificates is the manufacturer; the subscribers are the buyers of the intended product, while the funds realized from subscription are the cost of the product. The Islamic bank funding the manufacturer during the construction of the asset, acquires title to that asset and up on completion either immediately passes title to the developer on agreed deferred payment terms or, possibly, leases the asset to the developer under an Ijarah Sukuk. Shari’ah prohibits these certificates to be traded in the secondary market.

Istisna’a Sukuk are certificates that carry equal value and are issued to mobilize funds required for production of goods products that will be owned by the certificate holders. The issuer of these certificates is the manufacturer; the subscribers are the buyers of the intended product, while the funds realized from subscription are the cost of the product. The Islamic bank funding the manufacturer during the construction of the asset, acquires title to that asset and up on completion either immediately passes title to the developer on agreed deferred payment terms or, possibly, leases the asset to the developer under an Ijarah Sukuk. Shari’ah prohibits these certificates to be traded in the secondary market.