Diminishing Musharakah

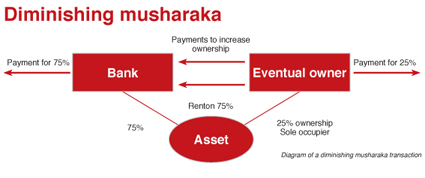

Diminishing Musharakah is a form of partnership, which ends with the complete ownership of a partner who purchases the share of another partner in that project by a redeeming mechanism agreed between both of them. Diminishing Musharakah is used mostly when one party who wants to own an asset or a commercial business which does not have adequate funds to pay the full price; and takes the assistance of financing from another party. The share of the financier is divided into a number of units and it is understood that the client will purchase the units of the share of the financier one by one periodically, thus increasing his own share till all the units of the financier are purchased by the client so as to make him the sole owner of the asset. In this kind of partnership, all partners are co-owners of each and every part of the joint property or asset on a pro-rata basis and one partner cannot make a claim to a specific part of the property or asset leaving the other parts for other partners.

Diminishing Musharakah can be conducted through shirkah al-aqd; in that case, the ratio of profit distribution for each partner can be disproportionate to the ratio of equity of both parties and has to be stipulated at the time of execution of the contract. In case of loss, it should be necessarily allocated in accordance with the ratio of equity at the time when the loss was incurred. The lessee partner can promise to buy periodically the share of the financer partner according to the market value or at a price to be agreed at the time of the sale. The price of share units cannot be fixed in the promise to sell

Diminishing Musharakah can also be conducted through shirkah al-milk, the ratio of profit distribution doesn’t need to be stipulated in the arrangement. Each partner will own the risk as well as the reward in proportionate to their individual share in the property or asset. The financing partner can lease its share to the other party and receive a rental for use of the leased part. The other party goes on paying the rental and purchasing the share of the financier partner in the form of ownership units, the rental payments will go on decreasing. He will also get the benefit of having the use of his part without paying any rent. One partner cannot purchase the ownership units representing the share of the co-partner at a pre-agreed price.

A contract of Diminishing Musharakah could take different shapes in different sub-contracts which come to play their role at different stages: partnership by ownership between two or more persons, leasing of the share of one partner in the asset to the other partner, and the sell of the share of one partner to the others. These sub-contracts are considered permissible in the Shari’ah given that one contract is not dependent on another and particularly when assets are sold or leased to partners. If all these sub-contracts have been combined by making each one of them a condition to the other, then this is not allowed, because it is a well settled rule in Shari‘ah that one transaction cannot be made a pre-condition for another. Thus, the relationship between the parties in a Diminishing Musharakah arrangement in the first stage is that of lessor and lessee and at the later stage is that of seller and buyer.

The proposed scheme, in case of Diminishing Musharakah, suggests that instead of making transactions conditional to each other, there should be promises from the client, firstly, to take share of the financier on lease and pay the agreed rent, and secondly, to purchase different units of the share of the financier at different stages at the price prevailing at the time of the sale. While the Islamic bank will be making a binding promise to offer a specific part of its ownership of the project for sale on a specified future date, at a price that will be determined at the time of the actual sale.

In addition, Diminishing Musharakah may be used in various cases of finance, particularly for financing of assets that can be leased. And as a variable or floating rate of return is possible in transactions involving leasing, Islamic banks can use it for long-term financing even in economies having an inflationary trend. For example, financial institutions can use Diminishing Musharakah for providing house financing, auto financing, plants and machinery financing, factory/building financing and financing of all other fixed assets. Financing on the basis of in thus form of partnership can take different structures depending upon the assets involved. For example, in home financing, in house financing, the facility can be provided for buying a house for occupation, for the construction of a house, for the renovation of a house already occupied and for replacing interest-based housing mortgages with a balance transfer facility (BTF). Moreover, the bank and the client bear the asset risk proportionately in Diminishing Musharakah; And in case the client is not able to purchase the bank’s units of ownership for a certain period, the bank will not incur loss as the rentals will continue to accrue.

Diminishing Musharakah can be conducted through shirkah al-aqd; in that case, the ratio of profit distribution for each partner can be disproportionate to the ratio of equity of both parties and has to be stipulated at the time of execution of the contract. In case of loss, it should be necessarily allocated in accordance with the ratio of equity at the time when the loss was incurred. The lessee partner can promise to buy periodically the share of the financer partner according to the market value or at a price to be agreed at the time of the sale. The price of share units cannot be fixed in the promise to sell

Diminishing Musharakah can also be conducted through shirkah al-milk, the ratio of profit distribution doesn’t need to be stipulated in the arrangement. Each partner will own the risk as well as the reward in proportionate to their individual share in the property or asset. The financing partner can lease its share to the other party and receive a rental for use of the leased part. The other party goes on paying the rental and purchasing the share of the financier partner in the form of ownership units, the rental payments will go on decreasing. He will also get the benefit of having the use of his part without paying any rent. One partner cannot purchase the ownership units representing the share of the co-partner at a pre-agreed price.

A contract of Diminishing Musharakah could take different shapes in different sub-contracts which come to play their role at different stages: partnership by ownership between two or more persons, leasing of the share of one partner in the asset to the other partner, and the sell of the share of one partner to the others. These sub-contracts are considered permissible in the Shari’ah given that one contract is not dependent on another and particularly when assets are sold or leased to partners. If all these sub-contracts have been combined by making each one of them a condition to the other, then this is not allowed, because it is a well settled rule in Shari‘ah that one transaction cannot be made a pre-condition for another. Thus, the relationship between the parties in a Diminishing Musharakah arrangement in the first stage is that of lessor and lessee and at the later stage is that of seller and buyer.

The proposed scheme, in case of Diminishing Musharakah, suggests that instead of making transactions conditional to each other, there should be promises from the client, firstly, to take share of the financier on lease and pay the agreed rent, and secondly, to purchase different units of the share of the financier at different stages at the price prevailing at the time of the sale. While the Islamic bank will be making a binding promise to offer a specific part of its ownership of the project for sale on a specified future date, at a price that will be determined at the time of the actual sale.

In addition, Diminishing Musharakah may be used in various cases of finance, particularly for financing of assets that can be leased. And as a variable or floating rate of return is possible in transactions involving leasing, Islamic banks can use it for long-term financing even in economies having an inflationary trend. For example, financial institutions can use Diminishing Musharakah for providing house financing, auto financing, plants and machinery financing, factory/building financing and financing of all other fixed assets. Financing on the basis of in thus form of partnership can take different structures depending upon the assets involved. For example, in home financing, in house financing, the facility can be provided for buying a house for occupation, for the construction of a house, for the renovation of a house already occupied and for replacing interest-based housing mortgages with a balance transfer facility (BTF). Moreover, the bank and the client bear the asset risk proportionately in Diminishing Musharakah; And in case the client is not able to purchase the bank’s units of ownership for a certain period, the bank will not incur loss as the rentals will continue to accrue.

The process of islamic bank's financing through Diminishing Musharakah

Islamic banks can use Diminishing Musharakah in various cases: to provide house financing, auto financing, plants and machinery financing, etc.

In the case of house financing for the purchase of a property, a joint ownership in proportionate shares to the level of the Islamic bank investment in the purchased property is created; a legal mortgage is taken on the client’s beneficial share to secure the obligation to the bank under the financing arrangement; the bank gives its undivided share on lease to the client. While, the client pays rent to the bank for the usage of its share of the property until the client has acquired the complete ownership. At that time the ownership of the property will be transferred to the client as the sole owner. The steps involved in a Diminishing Musharakah in the case of the purchase of a house are as follows:

First the client approaches an Islamic bank for the purchase of the property that he already identified; he agrees to invest a certain amount towards the purchase and applies to the bank for financing the balance amount. If the bank is satisfied about the title to the house and the future cash flow of the client, a Diminishing Musharakah agreement is created in terms of which the client and the bank become co-owners in the house on the basis of shirkah al-milk. The vendor of the property sells it directly to the bank, in which the legal title to the property is vested; and the client as the eventual owner has immediate rights to occupation. The two parties agree at the start that their respective shares in the property shall be pro-rata, concerning their contributions towards the purchase price paid to the vendor.

The parties also agree that during the course of their partnership, which has an agreed date of termination, the client will purchase the financier's share in the property in instalments and for the price that the financier had paid for such share on the initial date of acquisition. As the client increases its share in the property, the bank's share correspondingly decreases by the same amount. In parallel to the Diminishing Musharakah agreement, the bank grants to the client a lease in respect of its share in the property. The lease is effective for as long as the bank has a share in the property. The arrangement also contains details about the nature of security / guarantee to be provided by the client and is normally an equitable mortgage on the financed property that encumbers the property as security for the repayment.

Finally, as security for the client's obligations to make payments of rent under the lease, the bank may require any additional security to secure its interest, particularly in view of the financial position of the client; this would be stipulated in the agreement.

The balance transfer facility (BTF) that replaces interest-based mortgage by a Shari’ah compliant house finance, also involves Diminishing Musharakah since it includes a sale and lease back. The fact that the client is already living in the house, the bank can start taking rent for occupying the part in the bank’s ownership from the first month after the first disbursement of the amount is made to the client.

The client will sell some Units of the ownership of the house to an Islamic bank, against which the client had previously availed interest-based finance; He will repay the interest-based finance to the original lender bank; While, the Islamic bank will take rent on its share of the joint ownership.

The client will regularly pay the rentals and will also periodically purchase the bank’s units of ownership by additional payments to the bank; the rental payment is reduced with the client’s ownership increasing over a period of time. This process will continue until the bank’s share of the ownership title in the house is completely transferred to the client. And if the client’s cash flow allows to purchase more Units, the Islamic banks may normally allow the purchase of up to 3 Units at a time at the agreed price and if the client intends to purchase more than that number, the bank will undertake a current valuation of the house and will share in the appreciation on its part of the investment up to a limited extent, giving the remainder to the client.

In the case of house financing for the purchase of a property, a joint ownership in proportionate shares to the level of the Islamic bank investment in the purchased property is created; a legal mortgage is taken on the client’s beneficial share to secure the obligation to the bank under the financing arrangement; the bank gives its undivided share on lease to the client. While, the client pays rent to the bank for the usage of its share of the property until the client has acquired the complete ownership. At that time the ownership of the property will be transferred to the client as the sole owner. The steps involved in a Diminishing Musharakah in the case of the purchase of a house are as follows:

First the client approaches an Islamic bank for the purchase of the property that he already identified; he agrees to invest a certain amount towards the purchase and applies to the bank for financing the balance amount. If the bank is satisfied about the title to the house and the future cash flow of the client, a Diminishing Musharakah agreement is created in terms of which the client and the bank become co-owners in the house on the basis of shirkah al-milk. The vendor of the property sells it directly to the bank, in which the legal title to the property is vested; and the client as the eventual owner has immediate rights to occupation. The two parties agree at the start that their respective shares in the property shall be pro-rata, concerning their contributions towards the purchase price paid to the vendor.

The parties also agree that during the course of their partnership, which has an agreed date of termination, the client will purchase the financier's share in the property in instalments and for the price that the financier had paid for such share on the initial date of acquisition. As the client increases its share in the property, the bank's share correspondingly decreases by the same amount. In parallel to the Diminishing Musharakah agreement, the bank grants to the client a lease in respect of its share in the property. The lease is effective for as long as the bank has a share in the property. The arrangement also contains details about the nature of security / guarantee to be provided by the client and is normally an equitable mortgage on the financed property that encumbers the property as security for the repayment.

Finally, as security for the client's obligations to make payments of rent under the lease, the bank may require any additional security to secure its interest, particularly in view of the financial position of the client; this would be stipulated in the agreement.

The balance transfer facility (BTF) that replaces interest-based mortgage by a Shari’ah compliant house finance, also involves Diminishing Musharakah since it includes a sale and lease back. The fact that the client is already living in the house, the bank can start taking rent for occupying the part in the bank’s ownership from the first month after the first disbursement of the amount is made to the client.

The client will sell some Units of the ownership of the house to an Islamic bank, against which the client had previously availed interest-based finance; He will repay the interest-based finance to the original lender bank; While, the Islamic bank will take rent on its share of the joint ownership.

The client will regularly pay the rentals and will also periodically purchase the bank’s units of ownership by additional payments to the bank; the rental payment is reduced with the client’s ownership increasing over a period of time. This process will continue until the bank’s share of the ownership title in the house is completely transferred to the client. And if the client’s cash flow allows to purchase more Units, the Islamic banks may normally allow the purchase of up to 3 Units at a time at the agreed price and if the client intends to purchase more than that number, the bank will undertake a current valuation of the house and will share in the appreciation on its part of the investment up to a limited extent, giving the remainder to the client.