Islamic ETF

An Exchange Traded Fund (ETF) is an open-ended, index-tracking unit trust fund that consists of a group of stocks that can be listed and traded on a stock exchange like a single stock.

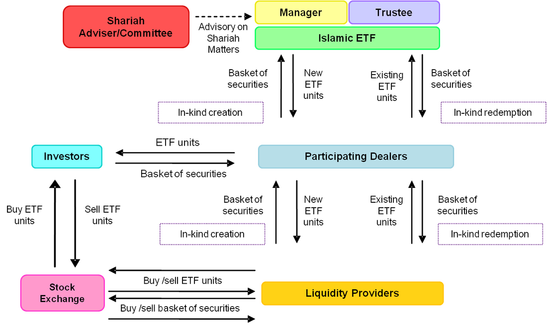

The principal objective of an ETF is to track or replicate the performance of a benchmark index. It provides investors, in a single transaction, a cost-efficient and convenient way to gain exposure to the basket of securities represented in the index. For that, it has a unique in-kind creation and redemption mechanism supported by a system of participating dealers and liquidity providers.

ETFs are listed and therefore their units can be bought and sold anytime during stock exchange trading hours. Investors buy and sell ETF units through their stockbroker rather than through unit trust agents.

The participants in ETF structure are as follows:

The main difference between a conventional ETF and Islamic ETF is the benchmark index that the Islamic ETF tracks.

An Islamic ETF tracks a benchmark index comprised wholly of constituent securities which are Shariah compliant whereas a conventional ETF may track any benchmark index regardless of the Shariah status of its constituents. In addition, an Islamic ETF is managed under the Shariah principle and guidelines, and overseen by an appointed Shariah committee. The Shariah committee conducts regular reviews and audits on the Islamic ETF to ensure strict compliance with the Shariah principles and practices.

The following diagram depicts the general structure of an Islamic ETF:

The principal objective of an ETF is to track or replicate the performance of a benchmark index. It provides investors, in a single transaction, a cost-efficient and convenient way to gain exposure to the basket of securities represented in the index. For that, it has a unique in-kind creation and redemption mechanism supported by a system of participating dealers and liquidity providers.

ETFs are listed and therefore their units can be bought and sold anytime during stock exchange trading hours. Investors buy and sell ETF units through their stockbroker rather than through unit trust agents.

The participants in ETF structure are as follows:

- The Manager: Manages/Administers the ETF in line with the trust deed and securities laws.

- The Trustee: Acts as custodian of an ETF’s assets. It also ensures ETF is administered in line with the trust deed and securities laws.

- The Participating Dealer: Performs or facilitates in-kind creation and redemption of ETF units. It can also act as a liquidity provider to facilitate the trading of ETF units on the stock exchange.

- The other Liquidity Providers (if any): Aid in providing liquidity to the ETF.

- The Investors: Invest in ETF units via their brokers.

The main difference between a conventional ETF and Islamic ETF is the benchmark index that the Islamic ETF tracks.

An Islamic ETF tracks a benchmark index comprised wholly of constituent securities which are Shariah compliant whereas a conventional ETF may track any benchmark index regardless of the Shariah status of its constituents. In addition, an Islamic ETF is managed under the Shariah principle and guidelines, and overseen by an appointed Shariah committee. The Shariah committee conducts regular reviews and audits on the Islamic ETF to ensure strict compliance with the Shariah principles and practices.

The following diagram depicts the general structure of an Islamic ETF: